what is the meaning of open end mortgage

A mortgage that provides for future advances on the mortgage and which so increases the amount of the mortgage. Keep in mind your borrowing limit depends on your homes value and the amount of your first mortgage.

The maximum amount that can be borrowed is normally capped at a certain financial figure.

. Like a traditional mortgage loan it gives the borrower enough cash to purchase a home. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. Specifically to comply with the Revised Code in addition to the parties intending it to be an open-end mortgage the mortgage must state at the beginning that it is an open-end mortgage.

A mortgage that allows the borrowing of additional sums often on the condition that a stated ratio of collateral value to the debt be maintained. A mortgage agreement against which new sums of money may be borrowed under certain. Open-ended mortgages give homeowners the flexibility to use the equity invested in their homes as a source of credit.

Meaning pronunciation translations and examples. A mortgage that allows the borrowing of additional sums often on the condition that a stated ratio of collateral value to the debt be maintained. An Open-end Mortgage is a distinct sort of house loan in which the client can utilize the loan money as required even when theyve bought the property.

However open-end mortgages are a less common type of home loan. Open-ended mortgages function like your credit. Open-end mortgage allows the borrower to borrow additional money on the same loan amount up to a certain limit.

The mortgagee may secure additional money from the mortgagor lender through an agreement which typically stipulates a maximum amount that can be borrowed. Open-end mortgages permit the borrower to go back to the lender and borrow more money. If approved you will be able to borrow additional funds on the same loan amount up to a limit established by the lender.

They can borrow against that amount as needed then pay down the balance. What is a closed mortgage. With an open-end mortgage borrowers take a loan for the maximum amount they qualify for.

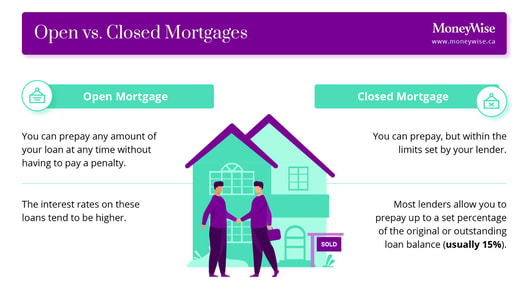

An open-end mortgage allows the borrower to increase the amount of the mortgage principal outstanding at a later time. The entire mortgage balance can be paid off in part or in full at any time and the contract can be refinanced or renegotiated without penalty. It provides the borrower with just enough money to purchase a property just like a standard new mortgage.

All Major Categories Covered. This type of mortgage makes sense for. It is a type of rotating credit wherein the borrower is entitled to get top up on the same loan subject to a.

Open-end mortgage saves borrower the effort of going somewhere else in search of a loan. In other words an open-end mortgage allows the borrower to increase the amount. A restrictive type of mortgage that cannot be prepaid renegotiated or refinanced without paying breakage costs to the lender.

There is usually a set dollar limit on the additional amount that can be borrowed. Wests Encyclopedia of American Law edition 2. Definition and Examples of an Open-End Mortgage.

However this scenario permits the lender to raise the loan balance at a future stage. Select Popular Legal Forms Packages of Any Category. It remains open and it permits the lender to make advances on the loan that are secured by the original mortgage.

As owner equity increases open-end mortgages permit the borrower to go back to the lender and borrow more money. A mortgage that provides for future advances on the mortgage and which so increases the amount of the mortgage. An open-end mortgage allows you to access your home equity and use the funds as necessary.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The definition of an open mortgage is pretty straightforward. The definition of an open-end mortgage underlines the fact that the mortgage or trust deed can be increased by the mortgagee borrower.

An open-end mortgage is one that permits the borrower to raise the amount of the outstanding mortgage principle at any moment. Wests Encyclopedia of American Law edition 2. This arrangement provides a line of credit rather than a lump-sum loan amount.

That might be a bit too complicated so well try. Borrowers with open-end mortgages can return to the lender and borrow more money. An open-end mortgage is also sometimes called a home improvement loan.

A mortgage loan that may allow future advances as the value of the property increases up to a certain percentage of loan-to-valueThe legal problem with this arrangement occurs when loan 1 is an open-end mortgage lender 2 loans money to the borrower and takes a second mortgage and then lender 1 advances additional money under. An open-end mortgage is a unique type of home loan in that the borrower has the opportunity to use the funds from the loan as needed even after they purchase the property. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit.

What is the definition of an Open-End Mortgage. A mortgage loan that may allow future advances as the value of the property increases up to a certain percentage of loan-to-valueThe legal problem with this arrangement occurs when loan 1 is an open-end mortgage lender 2 loans money to the borrower and takes a second mortgage and then lender 1 advances additional money under. In Ohio ORC 5301232 governs open-end mortgages and lenders must be certain to comply with the requirements of the statute in order to reap the benefits of an open-end mortgage.

Its kind of like a mortgage and home equity line of credit HELOC rolled into one loan when a property is purchased. With an open mortgage youll likely end up paying the prime rate plus a substantial premium.

If You Re Thinking About Buying A Home In 2018 November And December Are The Perfect Time To Warm Up For The Good Credit Home Buying Check Your Credit Score

Open House Feedback Form Real Estate Marketing Instant Etsy

Pin By Sophai On Student Life Notes Inspiration Study Notes School Study Tips

What Is An Open End Mortgage Rocket Mortgage

Facebook Posts For Mortgage Brokers Mega Bundle Of 123 Mortgage Broker Marketing Canva Templates Mortgage Social Media Pack Bestseller

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Mortgage Terms Home Buying Process Buying First Home Home Buying

Open Vs Closed Mortgage What S The Difference Lowestrates Ca

Mortgage Rates Canada Moneywise

How To Save Thousands Of Dollars On Your Mortgage Home Mortgage Mortgage Tips First Time Home Buyers

Referral Sources For Smart Los Mortgage Infographic Mortgage Protection Insurance Mortgage Loan Officer

:max_bytes(150000):strip_icc()/shutterstock_188743595.home.equity.loan.cropped-5bfc30d1c9e77c0026b5f52e.jpg)

:max_bytes(150000):strip_icc()/shutterstock_292433354.reverse.mortgage.cropped-5bfc31484cedfd0026c22351.jpg)

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)